The New Era of Solar: How the Vision Has Changed Without the Old Tax Credit

Welcome to 2026.

For years, the solar industry—and arguably the sales pitch—revolved around one heavy hitter: The Federal Investment Tax Credit (ITC). It was the "closer," the urgency driver, and the bold line item on every proposal. But as we stand here in January 2026, the landscape has shifted. The residential tax credit as we knew it has sunset, and while some predicted a slowdown, the reality is much more interesting.

We are seeing a market that is arguably healthier, more honest, and more focused on the real benefits of energy independence than ever before.

The "2028 Return" Myth: Don't Wait for a Ghost Train

One of the most common questions we hear in our consultations right now is, "I heard the tax credit is coming back in 2028, should I wait?"

Let’s clear this up immediately: No.

This misconception likely stems from confusion with commercial solar timelines or old phase-down schedules that no longer apply to residential homeowners. The hard truth is that waiting for a political "maybe" is a losing financial strategy. Why? Because the cost of waiting is now higher than the benefit of any potential future incentive.

Utility rates in Florida have continued their climb. If you wait two years for a credit that doesn't exist, you are exposing yourself to 24 months of escalating utility bills. By 2028, the money you "saved" by waiting will likely have been eaten up by the utility company’s rate hikes. The best time to lock in your energy cost was yesterday; the second best time is today.

The Puerto Rico Lesson: Solar Is Essential, Not Just "Incentivized"

If you want to see the future of solar, look at our neighbors in Puerto Rico. For over a decade, the island has been a powerhouse of solar adoption—not primarily because of a tax credit, but out of necessity.

In Puerto Rico, the "ROI" wasn't calculated on a tax form; it was calculated on the reality of survival and stability. Homeowners went solar because the grid was unreliable and expensive. They realized that a solar system was the only thing standing between them and weeks of darkness.

In 2026, Florida is moving closer to that mindset. We are no longer buying solar just to "get money back" from the government. We are buying it because relying solely on the grid is a liability. The "incentive" is no longer a check from the IRS—it’s the lights staying on when the rest of the neighborhood goes dark.

A More Honest Market

There is a hidden benefit to the end of the tax credit era: Price Transparency.

For years, some bad actors in the industry used the tax credit to artificially inflate prices. They would tell you, "Don't worry about the high price tag; the government pays for 30% of it!"

Now, that veil is lifted. The price you see is the price you pay, and it forces installers to be competitive and efficient. Equipment prices have stabilized and, in some sectors, reached historic lows. We are seeing a market that stands on its own merit, where the numbers have to make sense without a government crutch. This protects you, the consumer, ensuring you are investing in a system that is priced fairly for its actual value.

The Real Value: Savings, Resilience, and "Avoided Outage Costs"

Without the distraction of the tax credit, we can finally focus on the metrics that actually impact your life.

Resilience is Wealth: What is the cost of a 4-day power outage? It’s not just the inconvenience. It’s $300-$500 in spoiled groceries. It’s $150/night for a hotel room if the heat or humidity becomes unbearable. It’s lost wages if you work from home.

Avoided Outage Cost: When we calculate the value of a solar + battery system in 2026, we include these "Avoided Outage Costs." A system that keeps your fridge running and your WiFi on during a storm pays for itself in ways a tax credit never could.

Inflation Hedging: Your utility company has a business model built on increasing your rates forever. Solar is a business model built on locking in your rate for 25+ years.

The Bottom Line

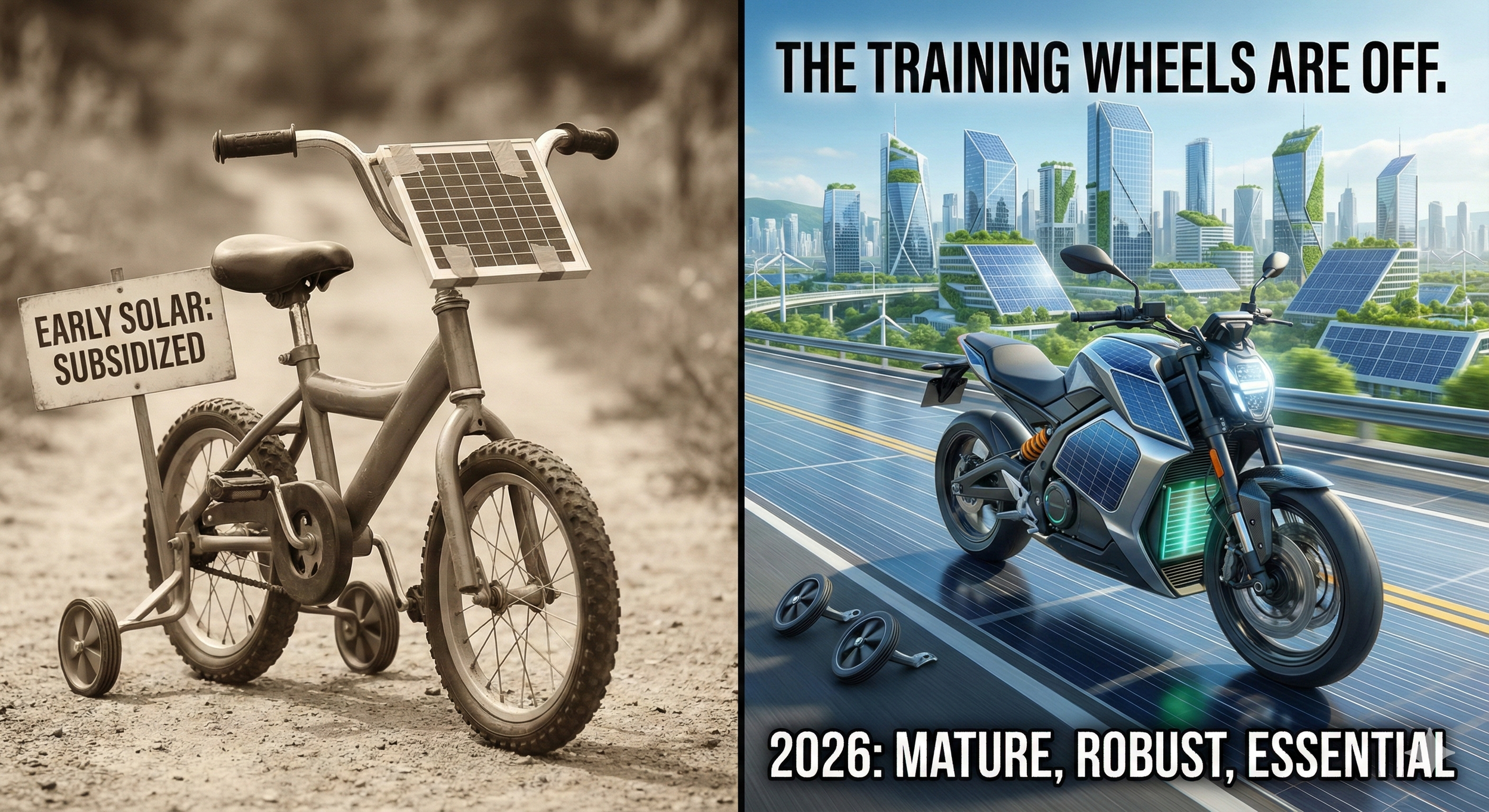

The training wheels are off. The solar industry of 2026 is mature, robust, and essential. We aren't selling a tax loophole anymore; we are selling a fortress for your home against rising costs and failing grids.

If you are ready to look at solar for what it really is—an investment in your home’s security and your financial freedom—let’s talk. The vision hasn't dimmed without the tax credit; it’s clearer than ever.